Outsourced Accountants for Small Accounting Firms

Engage a dedicated team of offshore Australian tax accountants, fully qualified and supervised by us. Stabilise your practice today.

WE CALL YOUEngage a dedicated team of offshore Australian tax accountants, fully qualified and supervised by us. Stabilise your practice today.

WE CALL YOU

Staffing costs dominate the budget of every small accounting practice. While client work may be plentiful, finding and retaining quality accountants remains a constant struggle. Each new hire demands significant investment in salary alone, plus the time and resources needed for training and integration.

This hiring conundrum leaves Australian accounting practice owners either overworked, living in constant fear of inevitable employee departures or struggling to grow their business at the pace they want.

Quality accountants command salaries of $150k or more - a cost that strains the resources of smaller practices.

The hiring and training process demands precious time and energy that practice owners simply do not have.

Resignations and hiring can place undue stress on small practices, which then puts client service, deadlines and revenue at risk.

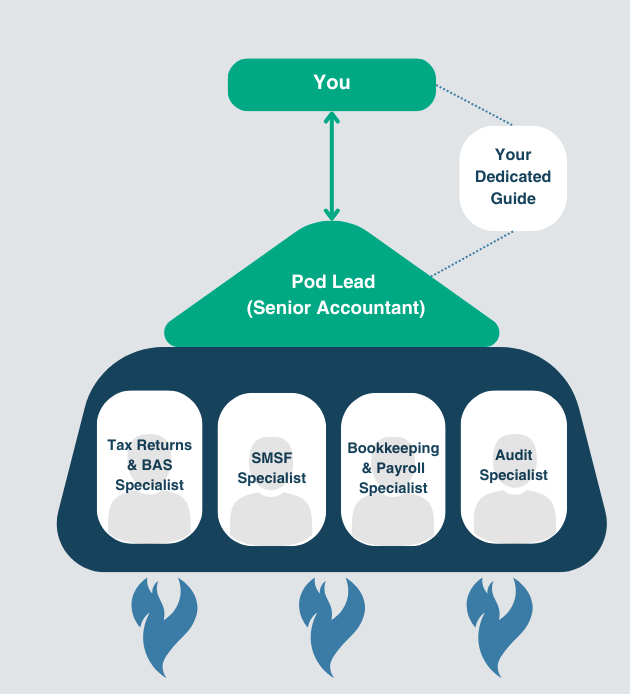

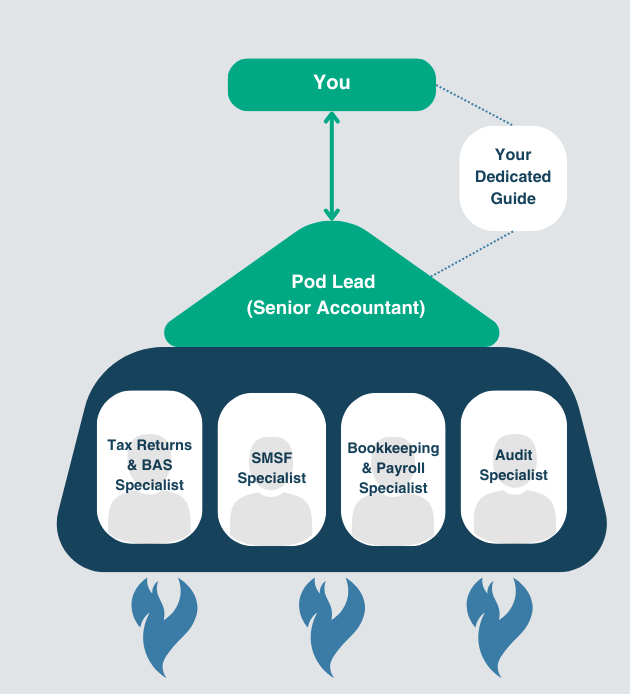

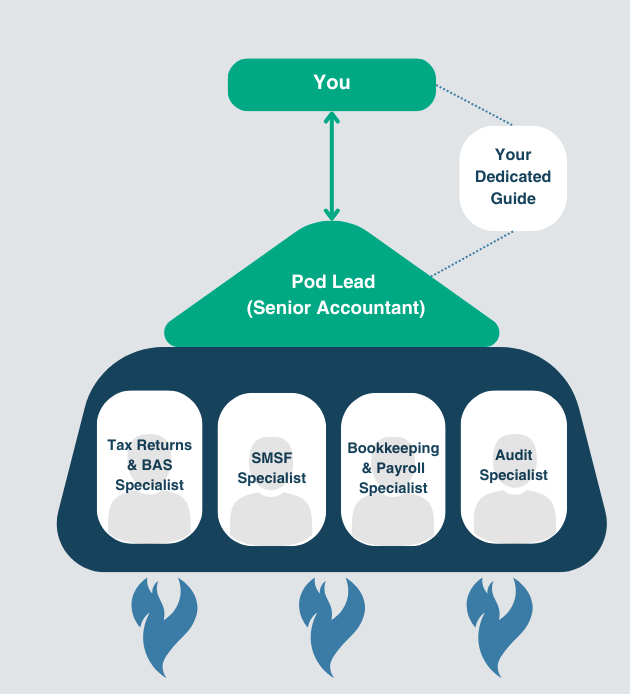

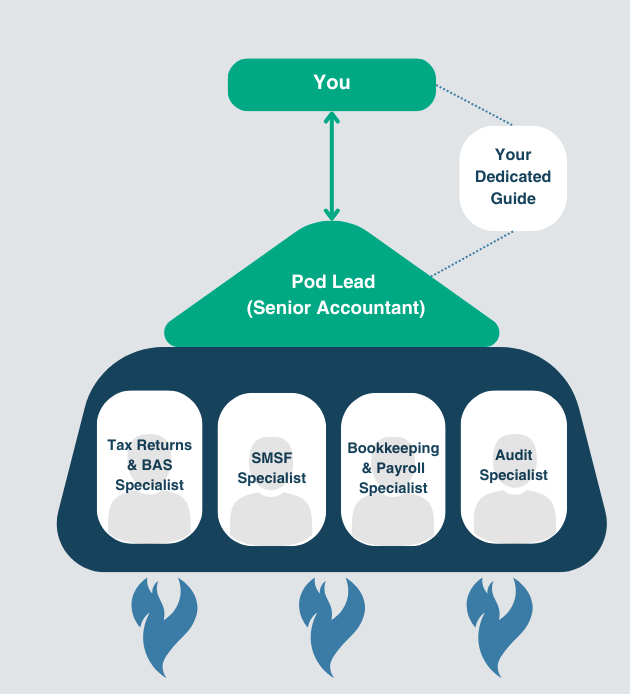

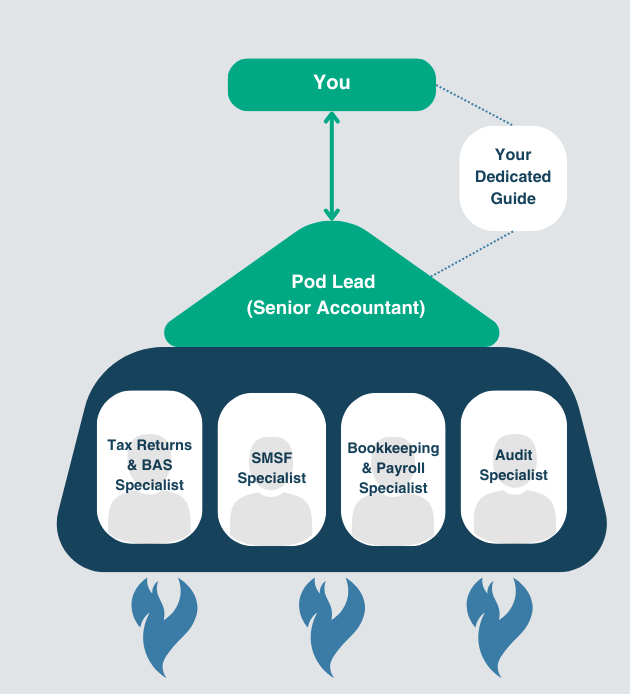

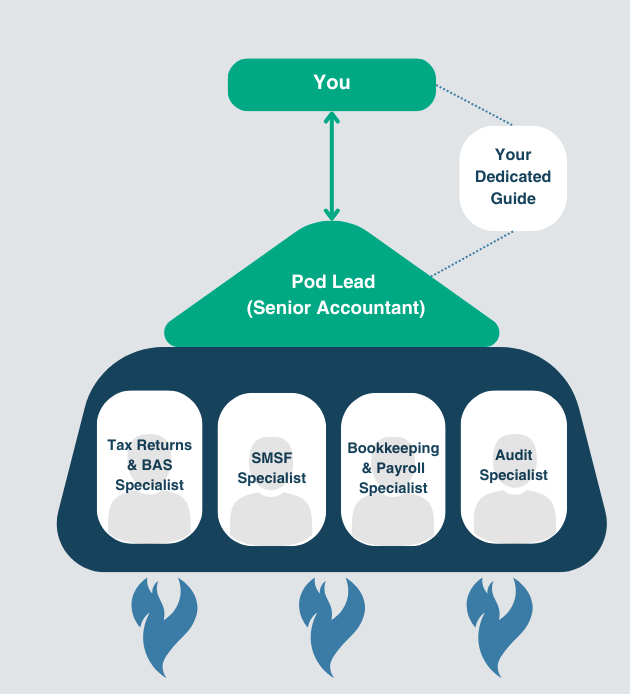

When you join Neil Outsourcing, you are not hiring staff, you are getting a solution. You are immediately allocated a dedicated Pod – your private team of accounting specialists. Your Pod comes with a single point of contact and adapts to your business needs. As your requirements change, your team can seamlessly adjust on a monthly, weekly, daily or even tasks basis!

Your Pod comes with all the expertise built in — eliminating the hidden catch of having to hire additional staff that comes with typical outsourcing.

Your dedicated single contact is a qualified Senior Accountant with many years of Australian tax experience. He/she is responsible for checking all work produced by the Pod, ensuring it's of the highest quality before going to you for final approval.

One contact point will manage your team. This streamlines communication across the Pod, reducing confusion and ensuring that messages, updates, and feedback are consistently conveyed without misinterpretation.

Our Senior Accountants have been with us for years, thriving in a culture that values retention and stability — which means your Pod's leadership is consistently reliable.

Never worry about hiring again! We have already hired and trained your specialists and so they are ready to hit the ground running.

Not only does Neil Outsourcing ensure your business has the right talent in place, we also ensure the people in your Pod are integrated quickly and managed properly.

We work with your Senior Accountant to adjust to your business’ unique working style, company values, and existing business processes. We foster seamless coordination & communication between you and your Senior Accountant.

Matthew and Kirstine operate from Melbourne and are reachable during work hours to answer any questions.

We do it all — bookkeeping, payroll, all Australian tax returns and BAS, SMSFs, and audits. If there’s an accounting service you need to offer, your pod offers it too.

Your highly skilled Pod ensures your clients’ financial records are accurate and up-to-date, reducing the risk of errors that could lead to financial discrepancies, compliance issues, or costly mistakes.

All our specialists are well-versed and stay up-to-date with the latest Australian accounting standards, tax laws, and regulatory requirements, ensuring your work remains compliant and avoids penalties or legal issues.

Your Pod is across the newest and best technology and can provide valuable advice to keep your practice ahead of the curve and adopt the best possible solutions for your clients.

Your Pod is composed of highly skilled specialists (including fully trained Accountants specialised in Australian Tax Law) who are specifically trained to meet Australian standards and regulations. All our outsourced accountants have years of experience in Australian tax work, so they are experts in handling complex tax laws and delivering high-quality, accurate work that aligns with your clients’ needs. With deep expertise across various accounting disciplines, our team ensures compliance, precision, and strategic insight, providing you with reliable financial management you can trust.

WE CALL YOU

Your dedicated Senior Accountant ensures your needs are clearly understood and addressed, coordinating with the entire Pod on your behalf so you never have to manage multiple points of communication. Importantly, all client communication remain with you — you stay in control. Your pod handles the work, but you’ll always have final approval. Whether you prefer email, phone, WhatsApp, or another communication channel, we adapt to your preferred method.

WE CALL YOU

Your sensitive financial information is protected with the highest level of security, for protection against malicious external or internal actors, confidentiality, and compliance with industry regulations.

We do not retain any data on our servers — your pod alone can access them via your cloud service providers. Passwords are stored only on the server and remain hidden from your Pod specialists. All systems are monitored, and data transfers and file access are tightly controlled.

To further secure the environment, USB ports on all servers and office machines are disabled, preventing the use of external drives. Phones, laptops, and access to personal emails or social networking sites are blocked and prohibited within the company premises. This comprehensive security framework guarantees the safety and integrity of your data.

WE CALL YOUWe get it — bringing in a new team is a big decision. That’s why we let you test-drive our expertise with zero risk. See exactly how our Pod’s skills can boost your efficiency and scale your operations, all before making a long-term commitment.

WE CALL YOUWe’ll talk for as long (or as little) as you like to ensure your toughest questions and trickiest curve balls are answered, and you feel completely confident in what we have to offer.

Trial Neil Outsourcing with our Pod by Hour plan — it’s the best way to experience our expertise firsthand and see immediate value without committing to a Pod by Month.

Once you are satisfied, we’ll seamlessly transition you to a Pod by Month plan. As your business grows or market demands change, your Pod adapts to ensure you always have the right expertise on hand.

We’ve got a really special proposition with Neil Outsourcing — and it boils down to the four partners. We invest in deep, respectful, and mutually beneficial relationships.

As a Chartered Accountant running his own firm, Matthew has spent the better part of two decades refining various outsourcing models, actively training staff in India, and developing the innovative Pod system for Australian accounting firms.

Whether it was memorizing cricket statistics, playing matches in scorching 42-degree heat, or having late-night discussions, Matthew’s dedication to understanding his overseas teams’ culture went far beyond the office walls. This personal investment has paid dividends, resulting in remarkably low turnover rates and a tight-knit, family-like atmosphere that set his team apart.

Matthew’s journey as a cultural bridge builder began originally back in 2000 at a European software vendor. There, he masterfully navigated the complex waters between Danish and English teams, and then went on to set up, lead and optimise an outsourced team in India. Matt’s journey breaking down communication barriers and facilitating effective collaboration continued developing over the years across Asia — Vietnam, Philippines, etc.

Today, Matt takes pleasure in helping his fellow accountant firm owners reduce stress and live happier lives.

We’ve got a really special proposition with Neil Outsourcing — and it boils down to the four partners. We invest in deep, respectful, and mutually beneficial relationships.

With a PhD in healthcare organisation and a talent for strategic thinking, Kirstine oversees system optimisation, contracts, compliance, and financial processes for our global team. Kirstine’s superpower lies in anticipating challenges further up the chain and implementing structures for sustained success. She ensures our clients’ processes run smoothly so they feel valued and protected.

As a Danish professional who’s worked extensively with universities, government bodies, and healthcare institutions, Kirstine brings a rich cross-cultural perspective to her role. Her background in optimising patient pathways taught her the delicate balance of maintaining efficiency while prioritising human connection. Today, she applies these insights to foster meaningful relationships across our international teams, finding joy in the mutual learning and growth that comes from cross-border collaboration.

Kirstine’s approach to business is deeply rooted in family values — prioritising fit and meaningful relationships over aggressive expansion. This philosophy shapes how she structures our work processes and how she nurtures our team culture, always ensuring that continuous improvement goes hand in hand with maintaining a healthy work-life balance for everyone involved.

We’ve got a really special proposition with Neil Outsourcing — and it boils down to the four partners. We invest in deep, respectful, and mutually beneficial relationships.

Neha’s path into chartered accountancy is marked by perseverance. Coming from a family of doctors and engineers, she was the first to venture into commerce. Her passion for numbers became evident early on when she topped her high school accountancy and taxation courses. In 2011, Neha completed her Chartered Accountancy course and quickly climbed the corporate ladder, starting as an Accounts Executive and earning a managerial role within just two years.

With a dream to someday build her own firm, Neha kept the vision alive while gaining hands-on experience in management, client relationships, and the intricacies of the accounting industry. In 2019, while on a trip to Himachal with her friend Ila, the two decided to strike out on their own as partners.

After working with Matt & Kirstine, they formally formed a strategic partnership with Neil Outsourcing, officially marking the beginning of their entrepreneurial journey. Their first office was established in Noida, and by 2022, they expanded with a second office in Chandigarh.

We’ve got a really special proposition with Neil Outsourcing — and it boils down to the four partners. We invest in deep, respectful, and mutually beneficial relationships.

Ila’s journey was bold and unexpected. Initially pursuing science and preparing for engineering entrance exams, she made a prescient overnight decision to switch to chartered accounting — a field she had no prior experience in but saw tremendous potential demand. The transition was challenging, but Ila’s determination saw her clear her Chartered Accountancy entrance exam on the first attempt. In 2012, she completed the program, solidifying her place in the profession.

From the beginning, Ila was drawn to the idea of creating something beyond a traditional accounting job — she aspired to build a firm that stood out for its values and client-first approach. Today, this is exactly what Neha and she have built together.

No matter how many services you offer or what plan you are on, you’ll only ever deal with one Senior Accountant who reviews everything. This keeps things simple and consistent while your Pod works behind the scenes to support your success.

Designed for once-off support, ad hoc tasks, short-term needs, and busy periods (like End of Financial Year). Allows owners to test our services without any long-term ommitments.

Perfect for ongoing, long-term support. The same team works with your processes and clients, providing consistency, boosting efficiency and delivering the best value for your business.

Never. You are charged down to the minute — no rounding up. If you use 10 minutes, that’s all you pay for. If you use 4 hours and 15 minutes, you are billed for exactly that time. You only pay for the amount of time you’ve used, nothing more.

Every client is unique – give us a call and let’s discuss your needs.

However many or few you need at any given time. It’s a “how long’s the piece of string?” scenario. We’ll never push another person into your Pod if they don’t need to be there, just like we’ll never remove someone from your Pod if your business requires their expertise. Many of our clients are able to have their business needs met with three-to-five people in their Pod.

Yes, for example, your Pod might just be three Bookkeepers if that’s what you need.

Yes, absolutely. We take great care in hiring top-tier, senior talent. Many of our hires have either lived in Australia or have worked for leading firms like KPMG. You’ll have a highly experienced senior accountant managing a team of skilled specialists. There’s virtually nothing they can’t handle.

Your single point of contact is a Senior Accountant, and possesses a high level of English proficiency, both spoken and written). They are fluent in the technical accounting language used in Australia, but they may have accents that take some getting used to. To ease communication during the onboarding process, we emphasise a couple of 3-way Zoom calls initially with Matt (based in Melbourne). Once a solid working relationship is established, email/Messenger/Teams communication becomes the norm. Just as you do with your local staff.

Managing staff remotely is made simple by our Pod model. No matter how large your team in India grows, you will only ever need to manage one Senior Accountant. This senior accountant will then oversee the rest of your team, ensuring smooth operations within the Pod.

From our experience, we have found our professionals to excel in mathematical and technical skills, often surpassing the expectations of our clients. Additionally, our employees tend to remain with good employers for longer periods, which leads to greater stability for your practice.

We’ve found that having each Pod work on Indian time works best for most of our clients. This allows you to have a quiet morning to focus, while your team works in the evening Australian time. By the next morning, all work will be ready for your review.

Our offshore office environment is highly secure. We enforce strict policies and have no printers, no USB ports on any of the computers, all passwords are encrypted and not visible to any employees and there are absolutely no mobile phones in the office during work hours. Our firewalls block access to social media. Employees also have no printing capabilities as there are no printers, ensuring that client data remains secure and private at all times.

Your Pod can handle all accounting services, including all Australian tax returns, BAS, Payroll, Payroll tax, Workcover, audits, and SMSF. They are fully equipped to execute any related accounting tasks you require. So, there’s nothing they can’t do. For many clients they do all the communication with the ATO – both by voice and portal messages.